Kenyans will experience a significant impact on their living standards as the Finance Act 2023 is implemented. This will result in increased financial difficulties due to inflation and reduced purchasing power.

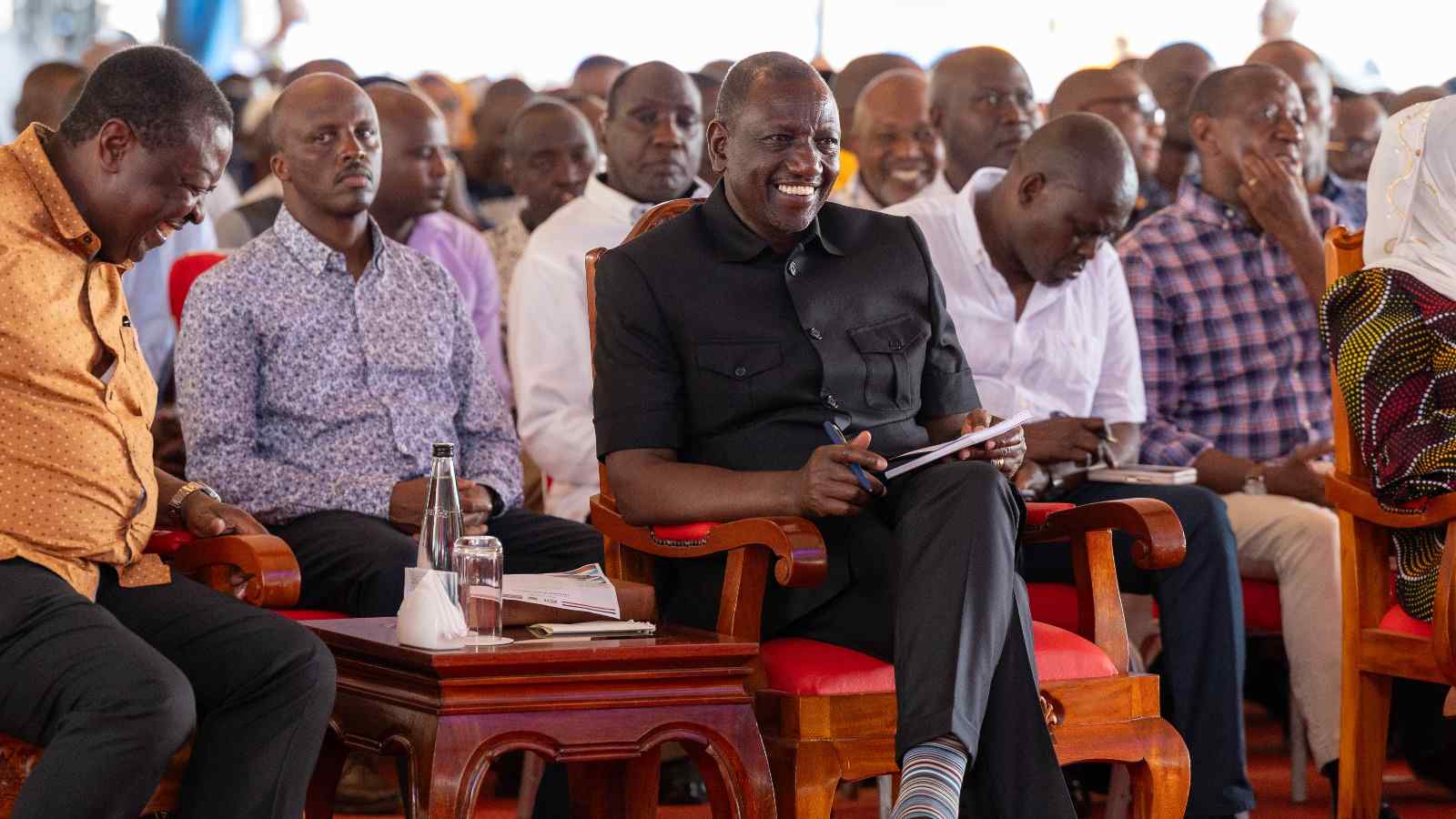

The government, led by Ruto, defends the new taxes, although they are expected to worsen the ongoing cost of living crisis.

To provide clarity on how these taxes will affect you, here are the key points:

1. Housing Levy

The Finance Act 2023 introduces a 1.5% monthly Affordable Housing Levy on both employees and employers, deducted from the gross salary. Employers must remit the levy within nine working days after each month. Non-compliance leads to a 2% penalty of unpaid funds per month. The levy aims to support the State’s affordable housing agenda.

2. Fuel (petrol, kerosene, and spirits)

The Act doubles the Value Added Tax (VAT) rate for fuel from 8% to 16%, resulting in increased energy costs for consumers. Petrol prices have risen, reaching nearly Sh200 per litre, significantly impacting motorists.

3. 15% excise duty on mobile money transfer services:

The Act increases the excise duty on fees for money transfer services by cellular phone service providers, such as Safaricom and Airtel.

Mobile money transfer charges have increased by 3%, while charges on calls, SMS, data, and home fiber have decreased by 5%.

4. Imported sugar and fish:

The Act introduces a 10% duty rate on imported fish and a new rate of Sh5 per kg of sugar, impacting the prices of these commodities.

5. Chamas:

The Act makes the income of members’ clubs or trade associations taxable, affecting Chamas.

MUST READ: 12 THINGS KENYANS ARE MOST PASSIONATE ABOUT

6. Turnover tax on SMEs:

The Act revises the threshold for turnover tax from Sh1 million to Sh25 million and increases the turnover tax rate from 1% to 3%. SMEs with income above Sh25 million under the TOT regime will now pay tax at the corporate rate of 30% on taxable profits.

7. Imported paints:

Imported paints, varnishes, and lacquers will face a new 15% duty rate, impacting the construction and building materials sector.

8. Powdered juice:

Powdered juice will have a new duty rate of Sh25 per kilogram, affecting the prices of juices.

9. 15% Excise duty on betting advertisements:

Advertisements on alcoholic beverages, betting, gaming, lotteries, and prize competitions on television, print media, billboards, and radio stations will be subject to a 15% fee, impacting media companies.

10. Daily remittance of excise duty:

Manufacturers of alcoholic beverages must remit excise duty within 24 hours upon removal of the goods from the stockroom. Betting and gaming service providers must remit excise duty by the following day’s end.

'Want to send us a story? Submit to NAIROBIminiBLOGGERS via our Email nairobiminiblogger@gmail.com'

Comments are closed.