Being listed in the Central Registry of Defaulters (CRB) in Kenya can have significant repercussions on one’s financial standing and reputation. Whether you have suspicions or simply want to stay proactive, checking your CRB status is crucial to safeguarding your creditworthiness.

In this article, we will explore two primary strategies to determine if your name is on the CRB list, emphasizing the importance of taking prompt action.

Option 1: TransUnion Nipashe App

One way to check your CRBs status is through the TransUnion Nipashe mobile application. This convenient option is available on the Play Market for Android users. After installing the app, ensure you are online to use it effectively.

Download the App

Visit the Play Market and download the TransUnion Nipashe app to your smartphone. Provide Your Information: Input your full name and ID number in the application.

Receive Instant Results: The app processes your request within seconds. If your name appears in the Central Registry of Defaulters, you will be flagged as a defaulter. Conversely, a favorable outcome indicates you are not listed in CRBs.

Option 2: SMS Verification

The second, simpler technique involves sending a text message to the number 21272. In the SMS, include your full name and ID number. This method is quick and cost-effective, with the message only requiring a few shillings.

MUST READ: How To Repay the Haraka Loan Faster

Compose the SMS: Type your full name and ID number in the text message.

Send the Message: Address the SMS to the number 21272 and hit send.

Receive the Alert: If your data is present in CRB, you will receive an alert confirming your listing.

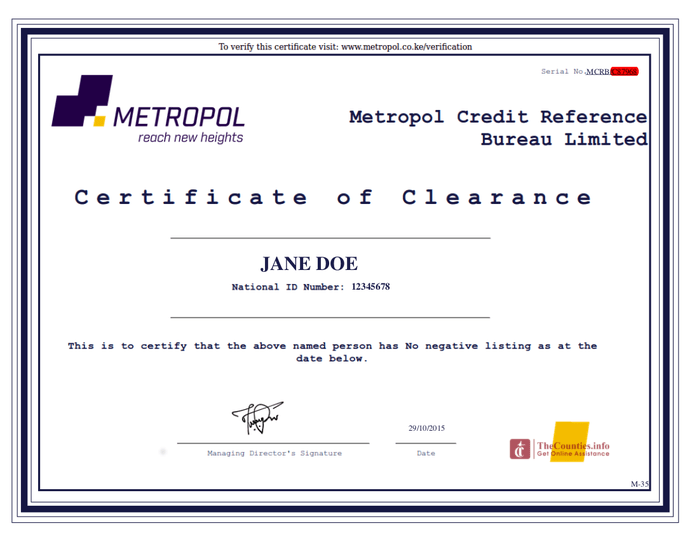

Importance of Timely CRB Clearance

Clearing your name from CRB is vital to maintaining a positive credit record. Delaying the process may lead to further damage to your financial reputation and credit score.

With a tarnished credit history, businesses may become hesitant to extend credit facilities to you, making financial transactions more challenging.

Efficient CRB Clearance Process

Thankfully, the CRB clearance process is straightforward and accessible to all. Simply visit one of the CRB offices, where dedicated staff will assist you. The process typically takes a few hours, ensuring you can resume financial transactions with a clean slate.

Monitoring your CRB status is a responsible financial practice that empowers you to protect your creditworthiness. Whether using the TransUnion Nipashe app or opting for SMS verification, swift action is key.

Promptly resolving any CRB issues will prevent lasting damage to your reputation and ease your future financial endeavors. Remember, a clean CRB record provides you with the confidence to access credit facilities and build a secure financial future.

Stay informed, act proactively, and safeguard your financial well-being.

'Want to send us a story? Submit to NAIROBIminiBLOGGERS via our Email nairobiminiblogger@gmail.com'

Wow, incredible weblog format! How lengthy have you been blogging for?

you made blogging look easy. The overall glance of your website is magnificent,

let alone the content material! You can see similar here najlepszy

sklep