15 Loans Without Security In Kenya Today

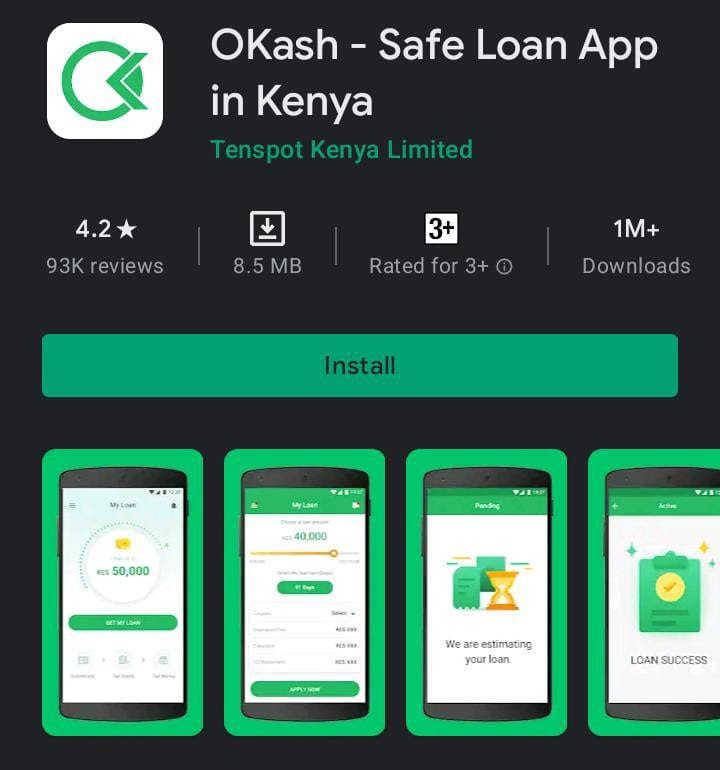

In Kenya, there are several loans without security options available for individuals who need quick access to funds. One such option is an unsecured loan, which does not require the borrower to put up any collateral to secure the loan. In this article, we will discuss 15 loans without security in Kenya that are available … Read more